For

Blockcare300 members we deal with Solicitors enquiries when a property sells.

Ringley Law offer 2 service levels:

- A complete preliminary enquiries service

- Support on a question by question basis as required

Or if you want to do it yourself, many of the documents you need can be easily stored in the

Document Upload Centre

Blockcare300 members get FREE banking*. Your own Ringley administered Client account (holding only funds for your site).

You DO NOT GET CHARGED FOR:

- your own bank account

- bank payments

- direct debit collections

- paying in receipts via a bank's postal or counter service

...ALSO, there are no monthly or quarterly account management charges.

...AND, members get interest on credit balances.

*provided it does not become overdrawn.

As well as:

- your own bank account (just for their block/estate),

- instant access to funds, and

- your funds are protected by the Royal Institution of Chartered Surveyors' Clients Money Protection Scheme (RICS)

All

Blockcare300 members receive the bank interest on any credit balance held.

Your funds will be held in trust in accordance with Section 42 of the 1987 Landlord & Tenant Act and the bank shall have no right of set off. Interest receivable on your discrete Client account is payable at a rate that reflects all funds held by Ringley and will be credited to your fund; no interest is payable for the 3 days that money passes through the DD, credit card, cheque clearing or internet banking transit account.

The bank that holds your funds does so in a discrete client account for the premises within which funds are held in trust in accordance with Section 42 of the 1987 Landlord & Tenant Act and the bank has no right of set off.

Blockcare300 members do not need a separate accountant to prepare their service charge accounts.

The 1985 Landord and Tenant Act requires that service charge accounts are prepared and served on those liable to contribute. The fine for not doing so is £2,500. To be compliant the accounts must contain the following:

- a schedule of debtors confirming each owners' arrears (if any) as at the year end date

- a breakdown of expenses - to enable a comparison against the budget

- the surplus or deficit

- a schedule showing which expenses have been apportioned to which owner

Service Charge Accounts do not need to be filed with Companies House, but the statutory accounts DO!

Service charge accounts must reflect the provisions of any lease or transfer document and need to be correctly prepared to support any arrears action through the Courts or Tribunal service.

We bring all members access to our buying power through Towergate insurance. By joining our block policy, Towergate will give you rates that you may not be able to achieve as a buyer of one insurance policy. This because we procure and insure thousands of customers. Towergate offer policies to cover all your insurance needs including: Buildings Insurance, Diretors and Officers insurance, Public Liability insurance and Engineering Inspection insurance (for lifts etc..)

Towergate are a major insurance provider for Management Companies and Residents Associations and reflect the needs of such entities.

Cover is offered at highly competitve rates and include many features that others charge for as extra.

Towergate support owners with their insurance claims by phone.

Blockcare300 members just need to quote their site ref to get a quote and put a property on cover.

To find out more call Robin Gleeson on 01442 2281236 TODAY

No Win No Fee Litigation - Arrears Collection

If you demand it wrong, then you cannot collect, so your demands need to:

- include the prescribed notes

- state the service address of landlord

- reflect the correct demand dates

- be budgeted to the correct year end....

- reflect charges that fall within the 18 month rule

- be reflected in a correctly prepared set of service charge accounts

What

members get is assurance that the service charge demands will stand up in a Court or Tribunal as we will demand the money correctly and prepare and present the service charge accounts to all owners. If necessary we will serve a Section 20B Notice to ensure that you are not prevented from collecting a deficit (should the accounts be late).* members get is assurance that the service charge demands will stand up in a Court or Tribunal as we will demand the money correctly and prepare and present the service charge accounts to all owners. If necessary we will serve a Section 20B Notice to ensure that you are not prevented from collecting a deficit (should the accounts be late).*

- You will still need to ensure that you adhere to statutory consultation procedures for any big works (any spend the liability for an owner exceeds £250) - or can instruct Ringley Law to run the Section 20 Consultation process for you.

For

members we will send out: members we will send out:

- the 1st demand (by post and email)

- polite reminder (by email)

- final notice (by email)

- our financial hardship policy (by email)

- pre-action letter to correspondence address

- pre-action letter to the property

All BlockCare members get protection as Ringley Law will litigate any service charge and ground rent arrears on a no-win, no-fee basis.**

To be eligible

- The debt must have accrued after you became a

member. member.

- Your annual subscription fee must be paid up to date.

- The service charge and/or ground rent must have been demanded in accordance with the lease.

**Arrears accrued prior to becoming a

member, we can still collect these but this will be subject to a chargeable evidencial review to advise you if there any procedural flaws and weigh up the merits of your case. To do so you will need to provide us with: member, we can still collect these but this will be subject to a chargeable evidencial review to advise you if there any procedural flaws and weigh up the merits of your case. To do so you will need to provide us with:

- A copy of the lease

- A copy of the service charge budget(s) for the period in which the debt accrued

- Audit trail of payments being received into a trust or client account

Ledgers for the property with arrears

- payment to cover the court fee

*Our responsibility for serving Section 20B Notices only applies to each full service charge year that we are appointed.

What if the case needs to go to Court or Tribunal

The no-win no-fee litigation service includes:

- all casework (advocacy is an extra but don't worry, less than 1% of cases proceed to hearing)

- arguments on reasonableness and recoverability

If you are unsure about whether you are demanding service charges in accordance with the lease, you should choose  so we manage this risk not you. so we manage this risk not you.

Blockcare300 members with a RTM, Freehold Company or Residents Management Company will need to prepare statutory accounts as well as service charge accounts. Service charge accounts are required where there are more than four owners paying service charge accounts to comply with the 1985 Landlord and Tenant Act and Company Accounts are required to comply with the Companies Acts.

For Resident Management Companies the company accounts that need to be prepared will be 'dormant company accounts' IF the these 3 tests are passed:

- the company does not have a bank account OTHER THAN the Ringley Client account we operate for you, and

- no assets have been bought or sold, and

- no income has been received (e.g., no ground rent or land sales)

For

Blockcare300 members as Company Secretarial support IS included, for any full accounting year we are appointed we will file your statutory accounts for free.

For part accounting years prior or post our administration, statutory accounts preparation is an optional extra.

Our service charge budget tool helps you prepare your budget and includes 8 best practice guidance notes referring you to the Code of Practice for Residential Managing Agents as prepared by the Royal Institution of Chartered Surveyors (RICS) and the Association of Residential Managing Agents (ARMA).

For

Blockcare300 Members authorising, adopting and splitting the budget is made easy, and, depends on the way you have asked to get set up initially. In short there are two authorisation scenarios:

- casting chairman - single person authorisation

- any 2 Directors - dual authorisation

For single person authorisation the lead person presses [SEND] to send the budget or payment request to us for payment, for dual person authorisation, person 1 emails the request to person 2 who then sends the request to us to action.

For

Blockcare300 members we will split the budget between the owners according to the percentages we are given during site set up, then we will send:

- the 1st demand (by post and email)

- polite reminder (by email)

- final notice (by email)

- our financial hardship policy (by email)

- pre-action letter to correspondence address

- pre-action letter to the property

ll membership levels can upload a lease to their private upload centre"

And, Ringley Law also offer a | "Bookmark your lease" service"

for just £40 + Vat and can advise you on key clauses and the exact service charge collection requirements for your site. So, if you want answers to questions like

Ever been curious as to how much it might cost you to redecorate the block, replace the roof, repair windows etc... We have a tool that helps all BlockCare members

Because Leaseholder Support.co.uk is part of Ringley - a property company providing services in Building Engineering, Surveying, Valuing and much more - Ringley's Building Engineers have put together a reserves fund estimator specially designed for leaseholders in small blocks.

The tool will guide you through questions such as how wide and deep is your block? how many flats are there? how many windows are there to build up key data on quantities?

It then asks you to rate each key element in simple terms, ie:

- New or in excellent order

- Some repair or maintenance required

- Renewal required

- Timber OK, putty replace & decoration

From a rate card that our Engineers review each year your "reserves requirement" will then be estimated. You can expand each item to understand how it is made up, ie. the size dimensions that you entered against the rate. There is a guide explaining things like access/scaffolding. Finally you can print your recommended reserves requirement or email to a friend.

Blockcare300 members are protected as we will take care of filing the Statutory Accounts and Confirmation Statements and are responsible for any fines insurred in any full accounting year we are appointed.

To be able to give you this guarantee you appoint us as a Shadow Director just to enable the following:

To

- execute share transfers when a property is sold;

- sign and submit the accounts to Companies House;

- sign and submit the Confirmation Statement to verify the shareholder or members register.

The filing responsibilities for full or part years prior to, or post our appointment, remain your responsibility.

No Win No Fee Litigation - Arrears Collection If you demand it wrong, then you cannot collect, so your demands need to:

- include the prescribed notes

- state the service address of landlord

- reflect the correct demand dates

- be budgeted to the correct year end....

- reflect charges that fall within the 18 month rule

- be reflected in a correctly prepared set of service charge accounts

What

Blockcare300 members get is assurance that the service charge demands will stand up in a Court or Tribunal as we will demand the money correctly and prepare and present the service charge accounts to all owners. If necessary we will serve a Section 20B Notice to ensure that you are not prevented from collecting a deficit (should the accounts be late).*

- You will still need to ensure that you adhere to statutory consultation procedures for any big works (any spend the liability for an owner exceeds £250) - or can instruct Ringley Law to run the Section 20 Consultation process for you.

For

Blockcare300 members we will send out:

- the 1st demand (by post and email)

- polite reminder (by email)

- final notice (by email)

- our financial hardship policy (by email)

- pre-action letter to correspondence address

- pre-action letter to the property

All BlockCare members get protection as Ringley Law will litigate any service charge and ground rent arrears on a no-win, no-fee basis.**

To be eligible

- The debt must have accrued after you became a Blockcare300 member.

- Your annual subscription fee must be paid up to date.

- The service charge and/or ground rent must have been demanded in accordance with the lease.

**Arrears accrued prior to becoming a Blockcare300 member, we can still collect these but this will be subject to a chargeable evidencial review to advise you if there any procedural flaws and weigh up the merits of your case. To do so you will need to provide us with:

- A copy of the lease

- A copy of the service charge budget(s) for the period in which the debt accrued

- Audit trail of payments being received into a trust or client account

Ledgers for the property with arrears

- payment to cover the court fee

*Our responsibility for serving Section 20B Notices only applies to each full service charge year that we are appointed.

What if the case needs to go to Court or Tribunal

The no-win no-fee litigation service includes:

- all casework (advocacy is an extra but don't worry, less than 1% of cases proceed to hearing)

- arguments on reasonableness and recoverability

If you are unsure about whether you are demanding service charges in accordance with the lease, you should choose Blockcare300 so we manage this risk not you.

All BolckCare members get access to our 70+ Company Secretarial tools, which include:

- Forms to incorporate a new company to buy your freehold to resolutions to de-regulate the management company.

Specifically:

- 12 forms for day to day running of the company

- 37 resolutions pre-incorporated into either AGM or EGM Notices covering almost every transaction from buying the freehold to removing a Director

- 4 forms you may need to fulfil the annual filing requirements

- 9 forms to change the structure of the company

- 8 forms/information notices

- 6 forms for issue or satisfaction of debentures, mortgages & dividends

For

Blockcare300 members we will:

- be appointed Secretary of the Company

- become the registered office

- maintain the register of Directors and Members / Shareholders

- file the Annual Confirmation Statement with Companies House

- deal with appointments & resignations

For  members we will keep their company running. In short we will: members we will keep their company running. In short we will:

- be your appointed Company Secretary

- become your registered office

- keep abreast of the role and legal changes

- maintain the Directors register

- maintain the Members or Shareholders register

- prepare and file the Annual Confirmation Statement

- prepare and execute share certificate transfers

- execute Licences to Assign (if the lease requires one when selling a flat)

- execute the Purchasers' Deed of Covenant (if the lease requires one when selling a flat)

- execute Compliance Certificates (if required by HM Land Registry to register a change in title)

- Receipt Notices of Transfer.

- Execute Licences to Alter (when so instructed by the Client)

- File the statutory accounts with Companies House **

Members also get access to over 70 company secretarial tools:

Forms to run your company

- 2 Forms required to incorporate a company

- 12 Forms used for day to day running of the company

- 3 Forms to fulfil annual filing requirements

- 9 Forms to change the structure of the company

- 8 Forms declaring the whereabouts of information and notices

- 6 Forms for use when contemplating Debentures, mortgages and dividends

Resolutions

- 74 pre-prepared Notices to call meetings to pass almost any resolutions you could need in the life of your Freehold or Management Company

Meetings

- 6 blank templates for minutes, meeting notices & proxy forms should you wish to draft an alternative to the 37 resolutions pre-prepared for you

members get everything they need to be able to take a professional non-payer to Court of Tribunal for service charge or ground rent arrears. members get everything they need to be able to take a professional non-payer to Court of Tribunal for service charge or ground rent arrears.

Members get NO WIN, NO FEE litigation on all arrears that accrue during a valid paid up subscription period.

For debts accruing prior to our appointment we can still act - but this will be subject to a chargeable evidencial review to weigh up the merits of your case. To do so you will need to provide us with:

- A copy of the lease

- A copy of the service charge budget(s) for the period in which the debt accrued

- Audit trail of payments being received into a trust or client account

Ledgers for the property with arrears

- payment to cover the court fee

What if the case needs to go to Court or Tribunal

The no-win no-fee litigation service includes:

- all casework (advocacy is an extra but don't worry, less than 1% of cases proceed to hearing)

- arguments on reasonableness and recoverability

If you are unsure about whether you are demanding service charges in accordance with the lease, you should choose  so we manage this risk not you. so we manage this risk not you.

Click to see more about the legal routes available

You cant really put a price on over 100+ factsheets written by our Surveyors, Valuers, Building Engineers and Property Managers (written originally for our staff and free inside knowledge to you). Learn how we make decisions, know what action to take next.

Here's the 8 categories available:

Previews

|

Cracks in Exterior Brickwork - "Tapered Cracks: Cracks which are thicker at one end tapering to a thinner crack at the other (often tapering to a hair line crack). Tapered cracks can indicate rotational settlement e.g. extension building is pulling away from main building leaving a gap..." |

|

Concrete Problems in Buildings - "Why are buildings built before 1970 more at risk? All concrete will carbonate to a greater or lesser extent, but the degree of risk depends on how deep the steel is sunk into the concrete and the extent of the protection it has. The level of cover over reinforcing grids or rods, that is cover by way of concrete, should be 50mm minimum and this is now stipulated in building regulations. However, in post war buildings only 1 inch (25mm) was stipulated and therefore carbonation is more likely to be a problem in 1940s, 1950s, and 1960s buildings..." |

For

Credit control is included. We will save you from suffering the embarrasement of needing to chase your neighbour for their arrears. Stages 1 to 3 of debtchase are included in the subscription fee, thereafter, legal action is rechargeable to the debtor. Credit control is included. We will save you from suffering the embarrasement of needing to chase your neighbour for their arrears. Stages 1 to 3 of debtchase are included in the subscription fee, thereafter, legal action is rechargeable to the debtor.

members can relax whilst we collect what the budgeted service charge. members can relax whilst we collect what the budgeted service charge.

For  members credit control includes us sending out: members credit control includes us sending out:

- the 1st demand (by post and email)

- polite reminder (by email)

- final notice (by email)

- our financial hardship policy (by email)

- pre-action letter to correspondence address

- pre-action letter to the property

Our processes are compliant with the Civil Procedure Rules pre-action protocol and includes the 30 waiting period prior to which Court action can commence.

Thereafter the debt collection routes are as detailed on the flowcharts below:

All BlockCare members get protection as Ringley Law will litigate any service charge and ground rent arrears on a no-win, no-fee basis.**

To be eligible

- The debt must have accrued after you became a

member. member.

- Your annual subscription fee must be paid up to date.

Credit Control Notes

Note 1 : BlockCare 300 is not suitable where the lease requires retrospective billing.

Note 2 : If service charge is not properly demanded - it may not be recoverable.

Note 3 : If an expense is not presented to an owner within 18 months of it being incurred recovery of it is barred by law (save for where a Section 20B Notice is served). For BlockCare 300 Clients we will serve a Section 20B Notice (if required) for any full service charge year in which we are appointed.

As a

Blockcare300 member Ringley Law can help you resolve defective lease issues and get you manageable.

Perhaps your lease

- only lets you collect service charges after you have spent the money, or

- does not mention something that you need to collect money for e.g., the lift, or

- is silent on the dates to collect the service charges, or

- does not allow you to collect a reserve fund, or

- caps the service charge collectable at an outdated amount (too low), or

- omits to say who repairs the windows, or

- only makes expenditure recoverable if certified by a surveyor/accountant

Perhaps it worked well until one owner decides not to pay and now you need to get a robust mechanism that works (after all a Court will only help you collect the arrears if you have done exactly what the lease says.

Using Section 37 of the 1987 Landlord and Tenant Act, so long as:

- 100% of owners consent to the proposed change, or

- 75% consent and not more than 10% oppose, (for blocks of 8+ flats), or

- all but 1 consent (for blocks of less than 8 flats)

then Ringley Law can resolve the situation for you through the Tribunal. The decision can be registered against the title to be binding on future owners too.

Sign up for BlockCare 100

Blockcare300 members can make payments to contractors and set up recurring payments for things like electricity, insurance premiums, cleaner, gardener etc.... It works a bit like online banking. You key who you want to pay, you can UPLOAD the invoice for safe storage, and then we make the payment for you.

In short there are two authorisation scenarios:

- casting chairman - single person authorisation

- any 2 Directors - dual authorisation

For single person authorisation the lead person presses [SEND] to send the budget or payment request to us for payment, for dual person authorisation, person 1 emails the request to person 2 who then sends the request to us to action.

So you choose the contractors you want and we will pay them, reconcile the bank account and produce the year end service charge accounts.

All BlockCare members get online tools to help them overcome problems that need strategic input.

The most common are:

- collecting arrears (accrued prior to you becoming a member)

- preparing accounts (for years prior to you becoming a member)

- changing lease(s) so you can collect money in advance

- extending leases to 999 years (where you own the freehold)

- post freehold purchase, deciding whether to collect ground rent

- de-regularise to not need to call Annual General Meetings (AGM's)

Support for these services is available to all BlockCare members on a pay as you go basis.

Advice on the principles for controlling or approving alterations is on the members panel, so all BlockCare Members get advice on the processes:

- to get alterations approved, and

- to deal with unauthorised alterations that could adversely affect on the building.

Most leases require a leaseholder to obtain consent before making any alterations - the document that approves the alternations is known as a Licence to Alter.

For obvious reasons there are precautions and procedures that need to be followed before a Licence should be granted. All BlockCare members get access to Ringley Building Engineering who can, as a pay-as-you-go extra, scrutinise proposals, inspect works and recommend that a Licence is granted (or not with reasons). Fees are chargeable to the owner wanting to make the alterations.

The most common alterations that do require a "Licence to Alter" are:

- installing an additional bathroom, shower or WC

- installing a new boiler flue (cutting through an external wall)

- installing a flue liner in a chimney shaft

- removing any wall, solid or partition wall within a flat

- changing any windows (where materials, transiems and mullions differ from the existing windows)

All members can use

Ringley Building Engineering Team to provide: Ringley Building Engineering Team to provide:

- provide a "desktop determination" to determine if a licence would be required,

- provide a list of due diligence requirements,

- assess information provided,

- assess works on site.

Ringley Law to: Ringley Law to:

- prepare and execute the Licence to Alter (permission to carry out the works). This then forms part of the lease and will be relied upon in conveyancing during Solicitors pre-sale enquiries.

- deal with unauthorised alterations

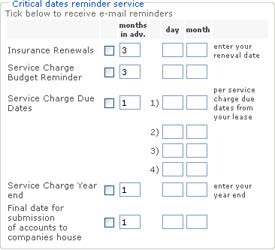

All BlockCare members can set up email reminders.

For example

- set the budget reminder, or

- renew the insurance, or

- call the Annual General Meeting

Blockcare300

members can relax as even IF you forget to log on and enter the service charge budget you want us to collect - we will simply apply a 10% increase to keep the block running, until you do

| |

No Win No Fee Litigation - Arrears Collection

No Win No Fee Litigation - Arrears Collection

Ringley Building Engineering Team to provide:

Ringley Building Engineering Team to provide: