What is a service charge on a property?

A service charge is a payment that a tenant or leaseholder must make towards the cost of services and repairs to the wider premises on which their property sits. It is charged in addition to normal rent property and covers the cost of providing communal or shared services to a building or a development, such as maintenance, cleaning, gardening, or security. The way charges are calculated and what they cover are set out in the tenancy agreement or the lease.

The service charge is a common feature of commercial leases and is intended to pass on the cost from a landlord to a tenant to recoup some or all of the landlord’s costs in respect of managing shared areas and facilities on multi-let sites and buildings. The charge can cover a range of important services, including repairs, maintenance, insurance, and management. The need for, and importance of, service charges in a commercial property lease can vary dramatically depending on the nature of a property. A small property occupying a site with a single occupant may have very limited need (if at all) for services provided or procured by the landlord. Conversely, a major retail, office, or mixed-use complex may have multiple shared areas, facilities, and significant associated upkeep costs.

The service charge provisions are usually set out in detail in the lease agreement between the landlord and tenant. The lease will specify what services the service charge covers, how they will be provided, how often they will be provided, and how much they will cost. The lease will also specify how the service charge will be calculated and how it will be collected from tenants.

It is important to note that no legislation currently applies to commercial property service charges, unlike its residential counterpart. Therefore, the lease between a tenant and their landlord is the most important document as it forms the legal basis upon which the landlord recovers the costs of providing and delivering the services from the tenant.

In summary, service charges are payments made by tenants or leaseholders towards communal or shared services provided by landlords. They are charged in addition to normal rent payments and cover various costs such as maintenance, cleaning, gardening, or security. How charges are calculated and what they cover are detailed in the tenancy agreement or lease between landlords and tenants.

What are Fixed or variable service charges?

Service charge are an integral part of many leasehold agreements. Tenants make payments to cover the costs of services, repairs, maintenance, insurance, improvements, or management. The two main types of service charges are fixed and variable.

Fixed service charges are a set amount that remains the same regardless of the year’s actual costs. The landlord usually determines them at the beginning of each year based on their estimates and costs. Fixed charges do not vary and therefore cannot be referred to the First Tier Tribunal for a decision on their reasonableness.

On the other hand, variable service charges change depending on the year’s actual costs. They are calculated based on the costs incurred or to be incurred during a specific period. Variable service charges are more common than fixed ones and are subject to statutory controls. These controls apply only to variable service charges, not fixed amounts.

Statutory controls on service charges have been in place since the Landlord and Tenant Act 1985. They regulate the level of service charges and prevent landlords from making late demands. The 18-month limit on recovery is one such control that limits a tenant’s liability to pay for costs incurred more than 18 months before a valid demand is made. The law applies differently to fixed and variable service charges.

Tenants need to understand the type of service charge they are paying and their rights and obligations under their lease agreement. While fixed service charges provide certainty in terms of payment amounts, variable service charges reflect the actual costs incurred and may change from year to year. Seeking professional advice or referring to relevant resources can help tenants navigate the complexities of service charges.

Please note that this article provides general information and should not be considered legal advice. For specific advice related to your situation, consult a legal professional.

Can I refuse to pay the service charge on my property?

The answer is not straightforward. According to legal obligations laid out in the lease agreement, tenants are generally required to pay the property service charge. Refusing to pay the service charge would be a breach of this obligation. However, if tenants dispute the service charges, they can apply for the appointment of a manager by the First-tier Tribunal (Property Chamber). This option is available when landlords make or intend to make unreasonable service charge demands or fail to fulfill their obligations under the lease.

It is important to note that the law states that service charges must be 'reasonable’. Both landlords and tenants have the right to ask the tribunal whether a charge or proposed charge is reasonable. However, the law does not explicitly define what constitutes ‘reasonable’.

If tenants believe that a service charge demand does not comply with legal requirements, they have a legal right not to pay until it is demanded properly. The law also states that any service charge contributions are held in trust by the landlord for the leaseholders.

While it may be tempting to refuse payment if you disagree with a service charge, it is crucial to understand your rights and obligations under your lease agreement. Seeking professional advice or referring to relevant resources can help tenants navigate the complexities of service charges.

Please note that this article provides general information and should not be considered legal advice. For specific advice related to your situation, consult a legal professional.

Service charge structure

The service charge provisions in a commercial lease are not governed by specific legislation like their residential counterparts. Instead, the lease agreement between a tenant and their landlord forms the legal basis upon which the landlord recovers the costs of providing and delivering services from the tenant. Landlords will want to ensure that they have the right to recover the full range of costs incurred in respect of services provided for the benefit of their tenants.

The service charge structure can vary depending on the type of property and lease agreement. In commercial leases, tenants usually agree to pay a service charge fee as part of the lease agreement. In return, landlords are obliged to provide certain services such as insuring and maintaining main structures in a shared facility. The extent of repairing obligations, bargaining powers of the parties, and the nature of the property influence what service charges cover.

Service charges in commercial property leases can often be negotiated. They cover various categories of services such as outside maintenance (gardening, paths, and roads), cleaning, and repair work to common areas. The specific services covered depend on factors like property type, tenant repairing obligations, and bargaining powers.

Understanding the service charge structure is crucial for both landlords and tenants. It helps landlords recover costs associated with managing shared areas and facilities while ensuring tenants receive necessary services. Tenants should review their lease agreements carefully to understand their rights and obligations regarding service charges. Seeking professional advice or referring to relevant resources can help navigate the complexities of service charges.

Please note that this article provides general information and should not be considered legal advice. For specific advice related to your situation, consult a legal professional.

How to calculate service charge on a property

To calculate the service charge for a property, you need to follow these steps:

- Determine the total cost of providing services: This includes all costs associated with maintaining the common areas of the building or complex. These costs can include cleaning, gardening, security, repairs, and maintenance.

- Calculate the total area of the property: This includes all areas that are shared by tenants, such as hallways, elevators, and stairwells.

- Determine the area of your property: This includes your unit as well as any private common and/or outdoor space that you have access to.

- One way to calculate your share of the service charge: One of the usual ways to do this is to divide the area of your property by the total area of the building or complex. Then multiply this number by the total cost of providing services. For example, let us say that a building has a total area of 10,000 square feet and a total service charge of £100,000 per year. Your unit has an area of 1,000 square feet. To calculate your share of the service charge, you would divide 1,000 by 10,000 to get 0.1. Then you would multiply 0.1 by £100,000 to get £10,000 per year.

- Another way to calculate your share of the service charge: Another way to do this based on the number of bedrooms within each flat. 3 bedroom flats will pay a certain percentage, 2 bedroom another and so on. This will all add up to 100%. For example if a block has 4 X 3 bed flats, 6 X 2 bed and 10 X 1 Bed then the service charge could well be 8%, 6% and 3.2% respectively, depending on how many bedrooms. In conclusion, calculating service charge for properties involves determining the total cost of providing services and dividing it among tenants based on their share of the total area. It is important to understand how service charges are calculated so that you can budget accordingly and avoid any surprises.

How to charge for property management services

Property management services are typically charged based on a percentage of the monthly rent or a fixed flat fee. The percentage can range from 4% to 12%, depending on factors such as the size, condition, and type of the property. Some property management companies may also charge additional fees for lease renewal, repairs, and maintenance. An initial setup fee may or may not be required to establish an account with the company.

Being on the expensive side, some property managers charge up to 10% of the ongoing monthly rent for finding a tenant. On the lower end of the scale, others charge just £99 as a one-off fixed fee. The exact services provided may vary, but there are significant savings to be made when selecting your property manager.

It is important to note that bounced payment fees are occasional fees charged when a tenant’s payment does not go through and the property manager has to do work to find the tenant and obtain payment in full.

To ensure transparency and accountability, property management companies should follow specific rules and regulations. These rules may include restrictions on how funds can be used, requirements for reporting and auditing, and guidelines for determining appropriate funding levels.

In conclusion, property management costs can vary depending on factors such as the size and type of the property. It is important to consider all associated fees when selecting a property manager. By understanding how property management fees work, you can make an informed decision that suits your needs and budget.

When a landlord demands a service charge on a business property, certain requirements must be met. According to The Leasehold Advisory Service,the demand must contain the landlord’s name and address which must be in England or Wales. An agent’s name and address are not sufficient. Additionally, the demand must include a “summary of leaseholders’ rights and obligations” which outlines details such as a leaseholder’s right to apply to the Tribunal.

Service charge in commercial properties can vary dramatically depending on the nature of the property. For example, a small property occupying a site with a single occupant may have a very limited need for services provided or procured by the landlord. The need for, and importance of, service charges in a commercial property lease can vary significantly.

Whilst not strictly legally required, it is generally advisable for service charge demands to include certain information. According to KDL Law, it is important for the recipient of the demand to know that the demand is for them and which property the demand relates to.

It is worth noting that service charge must be ‘reasonable’ according to the law. Both landlords and tenants have the right to ask the tribunal whether a charge or a proposed charge, is reasonable. However, what constitutes ‘reasonable’ is not explicitly defined by law.

In conclusion, when demanding service charge in business properties, landlords must meet specific requirements such as including their name and address in the demand. The need for service charge can vary depending on the nature of the property. It is generally advisable for service charge demands to include certain information to ensure transparency and accountability. Finally, service charge must be ‘reasonable’ according to the law, but what constitutes ‘reasonable’ is not explicitly defined.

18. Holding Service Charges – Trust Accounts (Section 42 of the Landlord and Tenant Act 1987)

Section 42 of the Landlord and Tenant Act 1987 stipulates that contributions to certain variable service charge funds and sinking funds for residential properties should be paid into a trust fund. This section requires that service charge contributions must be held in one or more trust funds. The law mandates that any service charge contributions are held in trust by the landlord, for the leaseholders. The money can be held in one or more accounts, such as a bank or building society, to be used for the purposes set out in the lease.

The trust fund is defined as the fund or any of the funds mentioned in subsection (2) of Section 424. Any sums paid to the payee by the contributing tenants by way of relevant service charge, and any investments representing those sums, shall be held by the payee either as a single fund or, if they think fit, in two or more separate funds. The payee shall hold any trust fund on trust to defray costs incurred in connection with the matters for which the relevant service charge were payable.

It is important to note that service charge funds must be held in trust. Landlords must account for all spending during the year by providing a summary of relevant costs if you or the secretary of the recognised Tenants’ Association asks for this in writing. After the landlord has provided the summary, you or the secretary can inspect the relevant documents.

In conclusion, Section 42 of the Landlord and Tenant Act 1987 ensures that service charge contributions are held in trust by landlords. This provision safeguards leaseholders’ interests and ensures transparency in financial matters. By holding these funds in trust accounts, landlords are required to use them only for matters outlined in the lease. This legal requirement provides peace of mind to leaseholders and promotes accountability among landlords.

What Do Service Charges Include?

Service charge are additional fees collected for providing a product or service. The specifics of a service charge will vary depending on the property or industry. In the context of residential properties, service charges typically cover various essential services and maintenance costs. Here are some common examples of what service charges may include:

General repairs: This category may include structural repairs and other maintenance work.

Cleaning: Service charge often cover the cost of cleaning communal areas such as hallways, lobbies, and shared facilities.

Refuse and waste collection: The cost of refuse collection and waste management services may be included in service charges.

Lighting: Service charge can contribute to the cost of lighting common areas within a property.

Heating: Charges may cover the cost of heating systems in shared spaces.

Air conditioning: If applicable, service charge may include the maintenance and operation of air conditioning systems.

Security: Costs associated with security measures, such as CCTV systems or security personnel, may be part of service charge.

Upkeep of communal garden areas: If the property has shared garden spaces, service charges might cover their maintenance.

Administrative fees: Service charge can include administrative costs related to managing the property and its services.

Insurance of the building: In most cases, insurance costs for the building may be included in service charge.

Cost of management: Service charge can contribute to the overall cost of managing the property , including administrative tasks and coordination.

Repairs, maintenance, and improvements: Service charge may cover expenses related to repairs, maintenance, and improvements in communal areas or the building structure.

It is important to note that service charge agreements vary depending on the property type and location. The specific coverage and amount to be paid will be outlined in your contract or lease agreement.

What are the requirements for service charge demands to be valid?

Specific requirements must be met when a competent landlord (the landlord immediately above the leaseholder who can demand a service charge) demands a service charge on a residential leasehold property. A demand simply having the landlord's name and address and an agent's name and address is insufficient. The Leasehold Advisory Service sets out what a service charge demand must contain and shows the amount demanded and the demand's period. A service charge demand must include a summary of leaseholder rights and obligations, which sets out a leaseholder's rights, such as that; they can apply to the Tribunal to determine the reasonableness of service charge.

Service charges in residential leasehold properties can vary dramatically.

Ultimately, how much service charge is payable depends on the building the property is situated in:

Height, type of construction, when it was maintained, as well as all the communal facilities and amenities, e.g., lifts, pumps, smoke vents, fire alarms, lightning conductors, water booster tanks, communal boilers, and what else needs taking care of such as insurance, service charge accounts, cleaning and gardening. For example, a small Victorian terraced building comprising three leasehold flats will have minimal services provided or procured by the landlord beyond perhaps the building's insurance and cleaning.

The law enshrines the principle that service charge must be reasonable. Both landlords and tenants have the right to ask the Tribunal to determine whether a service charge, levied or proposed, is sensible. However, the law does not explicitly define what constitutes reasonable; it is a matter of fact and degree.

The best practice is to ensure that the way and the items that service charges are levied for are transparent. For a bill to be regarded as reasonable by the payee, they must first understand it, and secondly, they must recognise that the items being charged for, such as plants, exist. Thirdly, more extensive reserve fund collections are necessary. The purpose of Section 20 consultation under the 1985 Landlord and Tenant Act is to serve notices to consult with owners. A, Stage 1 Section 20 notice effectively is a notice of intention to explain what works the landlord thinks are due and why. A section 20 stage 2 notice shared estimates obtained and advises which contractor will be chosen and how the works will be funded. Section 20 consultation notices are inextricably linked to how service charges are demanded and help in the mission to help leaseholders understand what they have to pay for and, therefore, feel that, on balance, the service charges they are being asked for are reasonable.

How do we determine what a service charge is and what is not?

In the context of small blocks of flats, service charges are collected for providing the service of running the block and paying for the building insurance, lifts, pumps, smoke vents, fire alarms, lightning conductors, water booster tanks, communal boilers, and what else needs taking care of such as compiling the service charge accounts, cleaning and gardening. The specifics of a service charge will vary depending on the type of property, when and how it was built, what condition it is in, and what works are planned. In managing residential leasehold blocks of flats, service charges typically cover various essential services and maintenance costs.

Most leases require the competent landlord to assemble a service charge budget to estimate the likely service charge costs for the coming financial year. The service charge budget is simply a list of likely expenditure headings and what the landlord thinks they will spend on each item. Remember, the landlord can be a freehold investor, a residents management company, a freehold management company, or a right-to-manage company. Some may employ a managing agent; others may put the budget together. Logically, the best way to start to put your service charge budget together is to look at expenditures over the past 18 months or so, work out what is recurring expenditure, and then review the likely unusual spending that needs to happen during the year, e.g., external decorations or roof renewal.

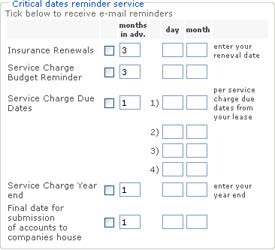

The team at servicechargesorted.co.uk has put together a budget widget that will help even the most novice person prepare their first service charge budget. The widget pre-loads the most common essential service charge budget headings and lets you add any extras.

On the servicechargesorted.co.uk website, you can easily see invoices from the last year and expenditure listings to help you get started.

The general principle of service charges is that whatever is named in the lease as a permitted service charge cost or covered by the internal, external, and structure-repairing clauses is a valid service charge expenditure. Costs that are not named in the lease are not permitted service charges. Let us have a look at some common examples of typical service charge budget headings:

General repairs: It is always worth putting a budget line item for minor maintenance work, such as repairing a TV Aerial, repairing a front door lock, or resetting dislodged bricks in a front garden wall.

Cleaning: Unless the leaseholders take responsibility for cleaning communal areas such as hallways, lobbies, and shared facilities, then the service charges need to cover the cost of cleaning.

Refuse and waste collection: while the local council tax you pay in the UK covers the cost of the local authority collecting domestic refuse, you may still need to collect service charges for renting commercial-sized wheel bins or Eurobins.

Removal of dumped items: While the cost of waste collection is covered by UK council tax, the Council will only collect waste in bins and not collect dumped beds, old kitchen units, etc. Not all leaseholders may understand that they need to deal with bulk waste removal. It is best to determine who dumps waste and recharge it to keep service charges down.

Lighting: a standard service charge item is the cost of lighting common areas.

Heating: service charges may need to cover the cost of heating systems in shared spaces.

For some blocks, the heating systems inside flats may be communal and therefore covered by the service charges.

Air conditioning: Some buildings have heat curtains and air conditioning systems for foyers, which need maintenance and repair.

Plant and equipment: A whole range of plants may be installed in your building, such as lifts, pumps, smoke vents, fire alarms, lightning conductors, water booster tanks, etc. The law requires some plants, e.g., lifts, to be inspected twice a year by a safety inspector; these are called LOLER tests, which are separate from the lift maintenance contract. Ideally, each block of flats should have a plant or asset register, which lists all the plant items in the block.

Security: can cover several items such as night security or door security, access and door control, and CCTV systems.

Upkeep of communal garden areas: if the property has shared garden spaces, service charges might cover their maintenance.

Administrative fees: Service charges usually include the administrative costs related to managing the property and its services; however, it is worth checking the lease, as such costs may not be recoverable on smaller blocks.

Buildings Insurance: Building insurance is ordinarily a permitted service charge expense. Check the lease; a few poorly drafted leases require owners to self-insure their flats. This is always a disaster, as each flat supports another in a block of flats, and the principle of ensuring a whole building is much better practice. If you have a poorly drafted lease, you can approach the Tribunal to rectify a poorly drafted lease.

Engineering insurance: it is legally required to put engineering inspection insurance in place if you have lifts, hoists, or other lifting equipment in your block of flats. The insurance company then sends an insurance engineer twice yearly for residential lifts to carry out various safety tests. It is essential to read the lift engineering inspection reports as it would be foolhardy not to take any recommendations given that the report's purpose is your safety.

Directors and officers insurance: Not all leases provide that directors and officers insurance or entity insurance can be put in place. Naturally, suppose you are a director of a resident's management company, right-to-manage company, or freehold management company. In that case, you will want this type of insurance to protect you and your decision-making.

The general rule of thumb is that if your lease was granted and incorporates a resident's management company, the cost of running the company, including directors' and officers' insurance, is a recoverable service charge expense. For freehold management companies and right-to-manage companies where block control was taken after the lease was conceived, this type of insurance would become a company cost, not a service charge cost.

Cost of management: someone has to manage blocks of flats. There are a range of administrative tasks to complete:

Budgeting, raising demands, banking monies received, managing the bank account, chasing arrears, coordinating repairs, maintenance, and improvements, dealing with owners who need information when selling their property, and more…

Accountancy fees: Most leases provide an accountant with the cost of preparing the service charge accounts and stating whether they should be 'certified' or 'audited.'

Costs are typically divided into three categories to calculate an average service charge: day-to-day costs, maintenance contract expenses, and reserve funds. Day-to-day costs include cleaning communal areas, insurance, and wages for building staff. Maintenance contract expenses cover plant and equipment installed in the building.

Reserve funds are set aside for more extensive repairs that come up infrequently but routinely, such as exterior and interior decoration or maintenance of drains and pipes.

I hope this section shows how service charges cover repairs, maintenance, and improvements in communal areas or the building structure.

Permitted heads of service charge for each building will vary, so the starting point is to check your contract or lease agreement.

Who pays the service charge, landlord or tenant?

The responsibility for paying the service charge is typically written into a residential lease. In leasehold law, the owner who buys a leasehold property is often referred to as a 'tenant' even though they own a lease for an extended period. While we ordinarily consider the word tenant in the 'landlord and tenant' context for a short tenancy, leaseholders are still referred to as tenants. In addition, the law that governs the relationship between freeholders and leaseholders is the Landlord and Tenant Acts.

Therefore, it is the lease that states there are service charges associated with the property. In simple terms, a lease is a contract; both parties agree to the terms and must abide by them, or else they will breach the lease. While, in practical terms, it is only the original leaseholder whose solicitor may have negotiated any terms set out in the lease, subsequent lease purchasers effectively take an assignment of the lease and are, therefore, bound by the original terms.

ach lease determines the leaseholder's contribution to the total service charge. Ordinarily, the actual service charge contribution you pay is based on the size of the flat and what it benefits from. Size may be the physical square footage of one flat as a percentage of the whole building or may be based on all 2-bed units paying the same even if they are a little differently sized. The principles of beneficial use are mostly practical; however, they are also established via cases taken to the Tribunal. For example, case law says ground floor flats should contribute to the lift's cost.

Where the service charge contributions each leaseholder must pay are not 100%, the landlord should make up the shortfall. This is why many modern leases do not state a service charge percentage. Instead, they say a leaseholder must pay a 'fair and reasonable' contribution. However, in the instance that service charge percentages do not add up to 100%, there may be a clause in the lease that allows the landlord or their surveyor to vary the percentages, which could solve the problem, or the landlord may apply to the Tribunal to ask that the lease percentages are varied using Section 35 or Section 37 of the Landlord and Tenant Act.

It is essential for landlords and tenants to clearly define who is responsible for paying the service charge and how much each leaseholder will contribute.

Many leases require the service charge budget to be served on the service charge payers. Leaseholders have various rights and obligations regarding service charges, which is why the law requires that the rights and obligations summary be included as an integral part of a service charge demand.

Leaseholders also have the right to ask for copies of every invoice spent if they serve a section 22 notice within six months of a set of service charge accounts being served upon them.

The law states that any service charge monies must be held in trust by the landlord for the leaseholders. This requirement is set down in Section 42 of the 1985 Landlord and Tenant Act and applies where the block of flats contains two or more dwellings. Section 42 also states, "On the termination of the lease of any of the contributing tenants, the tenant shall not be entitled to any part of any trust fund." This means that when a flat sells, the benefit of service charge payments a leaseholder makes transfers to the new leaseholder.

The principle of holding service charge contributions in trust means that the bank or building society account has no right to set off against monies held.

So, for example, if the landlord gets into debt, the landlord's bank cannot use the service charges to cover the landlord's debt. The law clearly states that service charges are only used for purposes set out in the lease.

Landlord summary of relevant service charge costs

A good lease will require a landlord to prepare or procure an accountant to prepare a set of service charge accounts. Because, in principle, service charges are not for profit, meaning if what is collected is more than what is spent, the surplus that arises must be credited to the leaseholder's account. If there is a deficit (more is spent than collected), this is to be collected from the leaseholder as a balancing charge.

The balancing charge's effect, whether a credit or a debit, is to equalise the service charge and put it back into a position where service charges are levied = service charges incurred.

However, as with any set of accounts, there will be timing differences, so it is essential to have a basic understanding of a balance sheet. In simple terms, a balance sheet is a snapshot at a point in time, the relevant point being the year-end stated in the lease.

The balance sheet shows the monies held in the service charge bank account, the debtors (people who owe service charges), and the creditors (contractors owed funds for work done, e.g., a drain clearance invoice received but not yet paid).

A set of service charge accounts also has an 'income and expenditure' page; this differs from a typical company accounts format, which has a 'profit and loss' page. Both pages fulfil the same function, to show the income (invoiced or demanded) and the expenditure (invoices received whether paid or not), and the end for typical company accounts is either a profit or loss. The difference in service charge accounts is that the end of the income and expenditure account is a 'surplus' or 'deficit,' which is then levied as a 'balancing charge' to equalise the fund.

What shows where on a set of service charge accounts?

The service charge accounts balance sheet: this reports on cash held, debtors, creditors, and reserves.

Service charge cash held: is simply the bank's cash balance on the date of the balance sheet, a snapshot of cash held at a point in time.

Service charge debtors: as perhaps not 100% of service charge demanded are received:

The shortfall between the two is a debt due to the company, which is shown as service charge debtors on the balance sheet.

Service charge creditors: As of the balance sheet date, perhaps not 100% of invoices received will have physically been paid from the bank. Expenses incurred, invoices received, or due to be received but not paid will show as creditors on the balance sheet.

Service charge reserves: this part of the balance sheet shows reserve funds collected as part of the service charge and held from one year to the following year.

The service charge accounts for the income and expenditure page

Service charge income: this shows all service charges demanded; it is simply the total of demands sent, which should be the same as the total of the service charges budgeted, assuming that leaseholder contributions add up to 100%. Service charges demanded but not received are shown as 'debtors' on the balance sheet.

Service charge expenditure shows all invoices received or receivable up to the end of the year. Unpaid invoices are also demonstrated as creditors' invoices due on the balance sheet.

Service charges and the right to inspect

Section 22 of the Landlord and Tenant Act 1985 provides that landlords must provide a summary of relevant costs if requested by tenants or the secretary of a recognised tenants association. After receiving this summary, tenants or secretaries can inspect relevant documents.

This provision aims to ensure transparency and accountability when managing service charges.

Under Section 22, tenants can require landlords to provide a written summary of costs incurred. The summary should cover the previous accounting period, typically the previous service charge year. Landlords must outline the expenses to demonstrate how they have been demanded or will be reflected in future service charge demands. The summary should include:

- Costs for which no demand for payment was received during the accounting period but were paid by the landlord within that period.

- Costs for which a demand was received but no payment was made during the accounting period.

- Costs for which a demand was received and payment was made during the accounting period.

- Costs related to works eligible for an improvement grant.

- The aggregate amount received by the landlord up to the end of the accounting period still stands to the credit of leaseholders.

Landlords must provide this information within one month or six months of the year-end, whichever is later. Failure to provide service charge accounts can be reported to the Council, fining the landlord up to £2,500.

The right to access a summary of service charge accounts empowers tenants to scrutinise costs and hold landlords accountable. It helps prevent disputes and ensures that service charges are reasonable and properly accounted for.

What constitutes a reasonable service charge?

A service charge is considered reasonable if it is reasonably incurred and incurred on services or works of a reasonable standard. When assessing the reasonableness of service charges, a Tribunal will look at several factors to decide if a service charge is reasonable, including the size of the property, maintenance history, frequency with which work is carried out, if the work charged is for the benefit of the leaseholders collectively, and the standard of the work.

The lease sets out whether an item of expenditure can be recovered as service charges. It cannot be retrieved if an expenditure item is not listed or implied. The most common mistake is to attempt to recover the costs of accounts for a freehold management company or right to manage company such as company accounts, directors, and officers insurance for company directors, as these costs will not be named in the lease, given the lease would not have conceived these costs when it was drafted as the lease will have created the freeholder managing the block and not that the leaseholders would club together to buy the freehold or to claim their right to organise.

There is further protection beyond the lease as the Landlord and Tenant Act 1985 also limits service charges payable; it states that the costs must be reasonably incurred and works must be reasonable. Various factors determine the concept of the reasonableness of a service charge. These include the size of the property, maintenance history, frequency of work carried out, whether the work benefits all leaseholders collectively, and the quality of the work. During Tribunal proceedings, the panel hears evidence and will assess these factors to determine whether a service charge was reasonable. It is important to note that there is no strict definition of what constitutes a reasonable service charge in law; instead, gradually, the caselaw and reasoning of different judges based on the evidence presented to them will establish principles.

To ensure that service charges are reasonable, landlords should focus on providing services valued for money; tendering and opting for a reasonable quote is the best way to demonstrate this. So, maintaining good records is critical. Good record keeping helps a landlord protect themselves if they face a Tribunal application to determine the reasonableness of service charges incurred. Indeed, a worried landlord with a big project can take pre-emptive steps and apply to the Tribunal himself to have the Tribunal rule that the service charges he intends to levy are reasonable. One challenge a landlord has to consider is that, since the Garside case, the reasonableness of a service charge also considers the playability of the leaseholders, so a sudden collection for significant works can be problematic or be ruled unreasonable. This is why collecting reserves is essential and why a lease that does not allow the collection of reserves is problematic. For example, when a lease does not have a reserves clause, a Tribunal may prefer that significant works be broken down into smaller projects and staggered over several years to follow the principles set down in the Garside case.

In summary, a service charge is considered reasonable if it is reasonably incurred and incurred on services or works of a reasonable standard. The Tribunal takes into account various factors when determining reasonableness. Both landlords and leaseholders have rights and responsibilities regarding service charges. Maintaining transparency and ensuring that costs are justifiable and work is carried out to an acceptable standard is essential.

Rights to further information about the service charges payable

Inspecting accounts and receipts' Section 22 of the Landlord and Tenant Act 1985

Section 22 of the Landlord and Tenant Act 1985 grants leaseholders the right to inspect accounts, receipts, and other documents related to their service charges. This provision lets leaseholders better understand how their service charge money is spent.

Within six months of receiving a summary of relevant costs or receipt of the service charge accounts, leaseholders or the secretary of a recognised tenants association can write to the landlord requesting access to and inspection of the accounts, receipts, and other relevant documents. The landlord is then obliged to provide the documents or facilities for copying them. This right aims to ensure transparency and accountability in managing service charges.

The time limit for a landlord to respond to a Section 22 request

The relevant costs should be summarised within one month of the request or six months of the end of the accounting period, whichever is later. If there are more than four flats in the building, the summary should be certified by a qualified accountant. After receiving the summary, leaseholders have an additional six months to request an inspection of receipts, accounts, and other documents. The landlord must provide facilities for inspection within one month of this request and make them available for two months.

By exercising their rights under section 22, leaseholders can ensure that their service charges are used appropriately. This provision promotes transparency and helps prevent any potential misuse of funds. It empowers leaseholders to actively participate in the management of their properties and hold landlords accountable for their financial decisions. That said, all customers of servicechargesorted.co.uk could see all invoices incurred and paid online on the servicechargesorted.co.uk portal 24 hours a day because transparency in how service charges are administered is a right that a leaseholder should not have to request.

Do service charges include council tax?

In short, no.

Service charge relate to communal aspects of insuring, maintaining, and running a block of flats. In contrast, council tax is levied on the unit's owner and relates to the services the Council provides to a flat occupier, such as roads, streetlights, etc. Service charges are the property owner's costs, whereas council tax is the property occupier's.

However, both are charges that are often associated with living in a property:

Service charge cover the cost of maintaining and managing shared areas and services within a building or estate; the council tax is a local tax that contributes to the funding of local services provided by the local authority.

The leaseholders typically pay service charges for the person who owns the long lease, not a tenant renting the property in the short term. Service charges cover building maintenance, repairs, insurance, cleaning, and communal facilities. Service charges are usually calculated based on costs the landlord or managing agent likely incurred. They are payable by the property owners according to the percentage or proportion set out in their lease.

Can you refuse to pay a service charge?

Service charges are payments made to a landlord or freeholder representing your share of the cost of running the communal areas and services and building insurance of a block of flats. Therefore, service charges are not discretionary. However, you must weigh the risks if you need to dispute your service charge.

Financial help available to help you pay your service charge?

In the UK Housing, benefit is a financial support scheme provided by the government to help individuals pay for their housing costs: housing benefit is designed to assist those who are on a low income and need assistance with their housing costs, which might include service charges that they need to pay.

According to Shelter England, most service charges are eligible for housing benefits. However, there are exceptions. For instance, water, gas, and electricity supplied directly to your home are not eligible. These are occupier usage costs, not the costs of the housing itself. Universal Credit rules differ slightly from those for Housing Benefit. For example, Universal Credit does not cover window cleaning costs for ground-floor properties.

Service charges related to non-communal daily living expenses are generally ineligible for housing benefits. So, when assessing a claim, the local authority deducts ineligible items when calculating what they decide is eligible.

Homeowners cannot claim housing benefits for service charges or other housing costs such as ground rent. However, leaseholders who have bought their property under a shared ownership scheme may be able to claim housing benefits to help with eligible service charges.

Homeowners not eligible for help from their local CouncilCouncil should approach their mortgage company. If service charges are not paid, the mortgage company risks the freeholder or landlord forfeiting the lease. Ordinarily, the mortgage company will pay the service charge to protect its security.

In summary, while most service charges are eligible for housing benefits, there are exceptions, such as water, gas, and electricity supplied directly to your home.

Service charges on freehold properties

A service charge on a freehold property is often referred to as an estate charge.

Either way, maintaining communal areas on an estate, such as pumping stations, roads not adopted by the local authority, street lighting, tree maintenance, and gardening, is expensive. You can usually tell if a road is private instead of being adopted by the local authority by seeing a rumble strip, a ridge, or a break between two road grades.

Estate charges, like service charges, can be fixed or variable. The. The freeholder must follow the terms of the transfer document, which will contain covenants regarding what can be collected as estate charges, how, and when. In a mixed-tenure development with houses and apartments, the estate service charge covenants may be identical to the lease covenants related to estate charges.

When you buy a freehold property, you buy 'title absolute 'or' freehold title. The transfer deed usually defines the requirement to make an ongoing financial contribution to the estate's upkeep. The regime and method of managing an estate's communal areas, including woodland, private roads, and pathways, is determined when the developer first sells the individual homes—the liability to pay forms part of the purchase contract.

For several years, cash-strapped local authorities have passed the costs and responsibilities of maintaining residual land, roads, and services in many housing estates to the private sector. Because in English law, no more than four people or entities can own a title in land, the developer must either keep the responsibility for managing and maintaining any residual land and roads themselves or create a management company that will convey the land to them.

Naturally, the latter option is the norm as the developer wants to make a profit and move to the following site.

Post-setting up a Residents Management Company (RMC) means that the developer has two choices: either to find a willing purchaser and hand over the responsibility for onward maintenance to the residents or, if suitable volunteer directors are not seen, to appoint a management company to organise the necessary work on the estate and to recover the cost from homeowners. When a Managing Agent is appointed, it works on behalf of the Residents Management Company (RMC).

There is little to do for many housing estates, as the road will likely not need attention for many years. However, the dues must still be collected from homeowners, banked, arrears chased, bills paid, perhaps the odd pumping station fault attended to, and end-of-year service charge accounts produced.

servicechargesorted.co.uk can take care of most of this: there are tools to help you budget; our team sends out the budget and demands, collects the arrears, manages a Client bank account for your site, and will pay bills that you tell us to.

Then, after the year-end, from the ins and outs of the bank account, we will prepare the service charge accounts and serve them on owners together with any balancing charge. In addition, it all costs less than a fully managed service from a managing agent; our Service Charge Sorted product is the closest thing to a low-cost managing agent. The only difference is that you get all the administration you need from a top 10 UK firm of chartered surveyors, but we act as the financial and legal administrator. You remain in charge of spending and decisions. Like online banking, you log on and do the budget, you put invoices you want us to pay on the portal, and we pay them from the funds in the bank account we run for you.

Can homeowners paying an estate service charge on a housing development challenge the cost?

As of writing this in 2023, the answer is "no". Freeholders have not had statutory rights to challenge unreasonable estate service charges for years. In contrast, long leaseholders who pay service charges in England and Wales have a statutory right to challenge unreasonable service charges and the standard of work carried out. Leaseholders can do this via the Tribunal, but freeholders cannot. Freeholders have minimal rights under the arrangements in the deeds or at common law, but these are not equivalent to the rights enjoyed by leaseholders under the terms of their leases and statutes.

This is all set to change. A bill going through parliament called 'The Leasehold and Freehold Reform Bill' will considerably improve the consumer rights of freeholders.

If you are considering purchasing a freehold property with service charge, carefully reviewing your transfer document or rent charge deed is crucial. It will define an eligible estate service charge and provide details on how it will be calculated and apportioned. While you may be able to challenge unreasonable estate service charges in the future, this does not mean that if you buy a property with a contract that requires you to pay estate service charges, you can avoid paying them altogether.

Service Charge law in England and Wales.

Statutory controls on service charges have been in place since the Landlord and Tenant Act 1985. These controls apply to variable service charges only, not fixed charges. The 1985 Act prevents landlords from making late demands for service charges by Section 20B of the Act, which says that if an expense is not presented to a leaseholder, either by way of the invoice itself or by way of the service charge accounts, then recovery of such charge is limited by law to £0.

Specifically, Section 20B says

"Limitation of service charges: time limit on making demands

S20(1)If any of the relevant costs taken into account in determining the amount of any service charge were incurred more than 18 months before a demand for payment of the service charge is served on the tenant, then (subject to subsection (2)), the tenant shall not be liable to pay so much of the service charge as reflects the costs so incurred.

S20(2) Subsection (1) shall not apply if, within 18 months beginning with the date when the relevant costs in question were incurred, the tenant was notified in writing that those costs had been incurred and that he would subsequently be required under the terms of his lease to contribute to them by the payment of a service charge.

This is why if you have a managing agent who has not prepared and served the service charge accounts to service charge payers within six months, they will most likely serve a Section 20B Notice to protect the landlord's right of recovery.

Many self-managed small estates and blocks of flats do not understand the implications of Section 20B, which can leave them in a pickle with no service charge accounts prepared and unable to collect service charges even if they have spent money reasonably and with the best intentions. Protecting Clients from this eventuality is one of the reasons that servicechargesorted.co.uk was created. We act as financial and legal administrators and keep things going so that if you do not have time to budget, we can prepare a budget for you and collect the service charges. We will send out demands, manage a Client bank account for you, and pay the bills you tell us to. After the year-end, we prepare the year-end accounts and serve them to the service charge payer. If the accounts are not ready on time, we must serve a Section 20B notice to protect the position.

In essence, what servicechargesorted.co.uk does is keep you safe from all of the legal loopholes self-managing small blocks of flats or housing estates may otherwise fall into. You still self-manage but with the service charges sorted for you.

The Service Charge Dispute Guide

A service charge dispute can arise between landlords and tenants. Landlords are legally obligated to prepare, and present service charge accounts to service charge payers with more than four dwellings in a building. Not doing so could expose the landlord to a £2,500 fine levied by the local authority. The leaseholder or tenant must pay and ensure their conveyancing solicitor helps them understand the lease terms before buying their property. Most service charge disputes centre on the 'reasonableness' of the service charges demanded. Therefore, if you find yourself in a service charge dispute, here is a guide to help you navigate the process:

Step 1: The first step in any dispute resolution is to write out your concerns to your landlord. Letters or emails are essential when disputing a service charge; they create a paper trail that, should you later need to go to the Tribunal, the Tribunal will use to not only assess a claim but potentially also limit the landlord's recovery of his legal costs if it feels the landlord has been unreasonable.

Step 2: If your letters are unanswered, it is time to formalise your complaint. Ask your landlord or managing agent for a copy of their formal complaints process. When a Managing Agent is appointed to oversee the block of flats or the estate and its service charge, they will usually have a formal complaints process.

Professional bodies such as the ARMA (Association of Residential Managing Agents) and the RICS (Royal Institution of Chartered Surveyors) require them to do so. Moreover, most professional bodies mandate that the Managing Agent is a member of a property ombudsman, giving you an alternative body to complain to. So, if you do not receive a satisfactory reply from your landlord, escalate your complaint by writing again as a formal complaint to be considered under their complaints procedure, notifying them that if they do not deal with it satisfactorily, then you will refer your complaint elsewhere.

Step 3: Apply to a Tribunal: If your complaint remains unresolved, you can apply to a Tribunal for further assistance. Their remit is deciding whether a service charge is 'reasonable' and 'payable.' Payable means that each cost incurred is a cost permitted by the lease.

Reasonable means reasonable in cost or quantum; this will be decided by reference to other expenses, quotes, etc.

As well as if the work was reasonably required. Reasonable also post the Garside case encompasses the speed by which collections are sought, so beware if you need to collect the cost of a complete redecoration in one year because your lease does not have a reserve fund clause.

It is essential to understand that the lease determines what services and works the service charge covers and how it is calculated. The law states that service charges and the work or services provided must be reasonable. Both tenants and landlords can question whether a charge or proposed charge is reasonable.

A useful source of informal advice is The Leasehold Advisory Service, a quango set up by the UK government to assist leaseholders and property owners. The service guides service charges, administration charges, ground rent, recognised tenant associations, forfeiture, and related issues. It also offers advice on alternative dispute resolution methods, such as mediation.

No Win No Fee Litigation - Arrears Collection

No Win No Fee Litigation - Arrears Collection

Ringley Building Engineering Team to provide:

Ringley Building Engineering Team to provide: