When you live in a block of flats, buildings insurance is one of the biggest costs covered by the service charge. It’s there to protect the block if something goes badly wrong – a fire, a flood, or major structural damage. But here’s the catch: if the building is under-insured, the whole block could be at risk, or in reality the people holding the responsibility to place the insurance are at risk. That’s because of something called the principle of averaging. In this blog, we’ll explain what under-insurance really means, how averaging works, and why getting the insurance figure right is so important for both leaseholders and management companies.

Under-insurance happens when the sum insured – the amount the policy says the building is covered for – is lower than the true rebuild cost. This isn’t the same as the market value of the flats, it is the estimation of the actual cost it would take to rebuild the block if it were destroyed. If the figure is set too low, the insurer may not pay out the full cost of repairs after a claim.

The principle of averaging means that if a building is under-insured, any claim payout is reduced in proportion to the level of under-insurance. For example, if the block is insured for only 70% of its true rebuild cost, the insurer may only pay 70% of any claim – even for a smaller repair. This rule is standard in insurance policies and is designed to stop policyholders from deliberately under-insuring to save money on premiums. By now, if you are still reading, you may understandably be worried about who would pick up the shortfall.

Under-insurance is such a risk for service charges because if a claim is reduced, the shortfall has to be covered somehow – and that usually means higher service charges. If the insurance payout doesn’t meet the cost of repairs, the extra costs fall back on the leaseholders through balancing charges. In extreme cases, this can mean very large unexpected bills for everyone in the block.

And, if the block burned down, the underinsured, perhaps a Freehold or Residents’ ManCo could be left with a shortfall that they need to collect from the members. But if the members refuse, directors could even face litigation for not arranging the insurance correctly.

The danger is even greater if under-insurance has been an ongoing issue for years. Old claims still fall under the averaging principle, which means leaseholders cannot go back and correct the payouts. There’s no easy fix for the past – but directors can protect the future. By commissioning a valuation now and setting the current policy accurately, they stop history repeating itself and keep both the building and leaseholders’ finances safe.

The safest way is to arrange for regular professional valuations of the building’s rebuild cost. Insurance brokers and surveyors can provide a proper reinstatement valuation, making sure the sum insured is accurate. This doesn’t just protect against under-insurance – it also reassures leaseholders that the service charge is being managed responsibly.

The RICS (Royal Institution of Chartered Surveyors) in the 4th Edition of the Service Charge Code for Residential Management states insurance reinstatement cost valuations should be carried out regularly, in the 3rd Edition it recommended three yearly. Ultimately, building costs go up and down and the rebuilding cost of a property is the derived from the built area, type of construction and current construction prices.

Leaseholders have the right to ask how the sum insured was set and whether a recent valuation has been done. If the figure seems low, they can raise it with the managing agent or directors. It’s always better to ask questions before a claim arises than to face the shock of a reduced payout later.

All membership levels get access to our national database of quality controlled contractors

Contractors across the UK are searchable by postcode and contractor type (gardeners, plumbers, electricians, general builders etc.)

Quality control is administered as every time a BlockCare 300 member instructs us to pay a bill the contractors performance is recorded.

Contractors need to get a "customer satisfaction form" signed by a person on site else in the event of a dispute we will act on your instructions not to pay the bill.

Contractors on our database are charged a nominal administration fee to cover the checking of public liability/contractors insurance, references and the management of customer service.

All membership levels also get access to our repairs liability matrix this will give you an inside the industry view of who should be liable for what.

Block Care members use the Pay Block Bills area to instruct us to pay their bills which we then pay by bank transfer, and, if so instructed can debit to an owner (if the problem was their responsibility).

All members get company secretarial support to ensure that they never miss the critical filing dates for filing both the Confirmation Statement and the Statutory Accounts.

To enable us to act and protect you from fines, we will be appointed as a Shadow Director with the following limited powers to:

*Excludes filing responsibilities prior to our appointment or for any part year if we are instructed during a service charge year.

All Blockcare100 members can access the forms they need online to prepare & File Accounts, Confirmation Statements and pass various Resolutions & More! You can use the 'email reminders tool' so you don't forget.

We have packaged the information the industry relies to make decisions...

Relax knowing that we are regulated by the Royal Institution of Chartered Surveyors (RICS) and will reconcile your bank account for you.

The objective of bank reconciliation is to ensure the manual/computerised cashbook ledger upon which decisions will be made, is accurate (because the cashbook ledger which records payments and receipts matches the physical bank account).

A cashbook is a ledger which shows the financial transactions being made into and out of an account.

Without a robust bank reconciliation process the integrity of credit control or arrears action is undermined.

Every company, including dormant and non trading companies, must file a confirmation statement. It confirms the information to Companies House hold about the company is up to date.

A confirmation statement must be filed at least once a year - or more often if there has been a significant change.

With BlockCare 300 we take care of this for you and debit the Companies House filing fee, currently £15, to the service charge bank account.

All Blockcare300 members get company secretarial support to ensure that they never miss the critical filing dates for filing both the Confirmation Statement and the Statutory Accounts, and, if we mess up we will pay any Companies House fines*.

To enable us to act and protect you from fines, we will be appointed as a Shadow Director with the following limited powers to:

*Excludes filing responsibilities prior to our appointment or for any part year if we are instructed during a service charge year.

All Blockcare100 members can access the forms they need online to prepare & File Accounts, Confirmation Statements and pass various Resolutions & More! You can use the 'email reminders tool' so you don't forget.

Blockcare300 members can pay their service charge by monthly direct debit, and, we will review payments when required, for example when:.

Blockcare300 members can update their ownership registers on-line at any time. This triggers RingleyLaw (our Solicitors) to review if there has been a notifiable event such as a change of owner or a sub-letting so they confirm the update.

Depending whether the property has been sold, or simply sub-let we will provide guidance on the selling or renting process.

Ringley Law will also deal with buyer's and seller's Solicitors and answer the preliminary enquiries to facilitate a sale, as well as dealing with share or membership transfers and updating both the ownership and shareholders or members registers also.

All Blockcare300 members get Company Secretarial support to:

To assist in executing documents, on set up Blockcare300 Members appoint us as a Shadow Director with the following limited powers:

What remains your responsibility as Client is to:

| a) | Minute meetings & keep any resolutions passed | |

| b) | Call the Annual General Meeting (AGM) | Downloadable from our helpdesk are:

|

| c) | To tell us if a Director needs appointing or resigning | Downloadable from our helpdesk are:

|

| d) | Pass company resolutions, e.g., to de-regulate and not need to call AGM's | Downloadable from our helpdesk are:

|

For Blockcare300 members we deal with Solicitors enquiries when a property sells.

Ringley Law offer 2 service levels:

Or if you want to do it yourself, many of the documents you need can be easily stored in the

Blockcare300 members get FREE banking*. Your own Ringley administered Client account (holding only funds for your site).

You DO NOT GET CHARGED FOR:

...ALSO, there are no monthly or quarterly account management charges.

...AND, members get interest on credit balances.

As well as:

All Blockcare300 members receive the bank interest on any credit balance held.

Your funds will be held in trust in accordance with Section 42 of the 1987 Landlord & Tenant Act and the bank shall have no right of set off. Interest receivable on your discrete Client account is payable at a rate that reflects all funds held by Ringley and will be credited to your fund; no interest is payable for the 3 days that money passes through the DD, credit card, cheque clearing or internet banking transit account.

The bank that holds your funds does so in a discrete client account for the premises within which funds are held in trust in accordance with Section 42 of the 1987 Landlord & Tenant Act and the bank has no right of set off.

Blockcare300 members do not need a separate accountant to prepare their service charge accounts.

The 1985 Landord and Tenant Act requires that service charge accounts are prepared and served on those liable to contribute. The fine for not doing so is £2,500. To be compliant the accounts must contain the following:

Service Charge Accounts do not need to be filed with Companies House, but the statutory accounts DO!

Service charge accounts must reflect the provisions of any lease or transfer document and need to be correctly prepared to support any arrears action through the Courts or Tribunal service.

We bring all members access to our buying power through Towergate insurance. By joining our block policy, Towergate will give you rates that you may not be able to achieve as a buyer of one insurance policy. This because we procure and insure thousands of customers. Towergate offer policies to cover all your insurance needs including: Buildings Insurance, Diretors and Officers insurance, Public Liability insurance and Engineering Inspection insurance (for lifts etc..)

Blockcare300 members just need to quote their site ref to get a quote and put a property on cover.

No Win No Fee Litigation - Arrears Collection

No Win No Fee Litigation - Arrears CollectionIf you demand it wrong, then you cannot collect, so your demands need to:

What

members get is assurance that the service charge demands will stand up in a Court or Tribunal as we will demand the money correctly and prepare and present the service charge accounts to all owners. If necessary we will serve a Section 20B Notice to ensure that you are not prevented from collecting a deficit (should the accounts be late).*

members get is assurance that the service charge demands will stand up in a Court or Tribunal as we will demand the money correctly and prepare and present the service charge accounts to all owners. If necessary we will serve a Section 20B Notice to ensure that you are not prevented from collecting a deficit (should the accounts be late).*

All BlockCare members get protection as Ringley Law will litigate any service charge and ground rent arrears on a no-win, no-fee basis.**

To be eligible

member.

member.**Arrears accrued prior to becoming a

member, we can still collect these but this will be subject to a chargeable evidencial review to advise you if there any procedural flaws and weigh up the merits of your case. To do so you will need to provide us with:

member, we can still collect these but this will be subject to a chargeable evidencial review to advise you if there any procedural flaws and weigh up the merits of your case. To do so you will need to provide us with:

*Our responsibility for serving Section 20B Notices only applies to each full service charge year that we are appointed.

What if the case needs to go to Court or Tribunal

The no-win no-fee litigation service includes:

If you are unsure about whether you are demanding service charges in accordance with the lease, you should choose  so we manage this risk not you.

so we manage this risk not you.

Blockcare300 members with a RTM, Freehold Company or Residents Management Company will need to prepare statutory accounts as well as service charge accounts. Service charge accounts are required where there are more than four owners paying service charge accounts to comply with the 1985 Landlord and Tenant Act and Company Accounts are required to comply with the Companies Acts.

For Resident Management Companies the company accounts that need to be prepared will be 'dormant company accounts' IF the these 3 tests are passed:

For Blockcare300 members as Company Secretarial support IS included, for any full accounting year we are appointed we will file your statutory accounts for free.

For part accounting years prior or post our administration, statutory accounts preparation is an optional extra.

Our service charge budget tool helps you prepare your budget and includes 8 best practice guidance notes referring you to the Code of Practice for Residential Managing Agents as prepared by the Royal Institution of Chartered Surveyors (RICS) and the Association of Residential Managing Agents (ARMA).

For Blockcare300 Members authorising, adopting and splitting the budget is made easy, and, depends on the way you have asked to get set up initially. In short there are two authorisation scenarios:

For single person authorisation the lead person presses [SEND] to send the budget or payment request to us for payment, for dual person authorisation, person 1 emails the request to person 2 who then sends the request to us to action.

For Blockcare300 members we will split the budget between the owners according to the percentages we are given during site set up, then we will send:

ll membership levels can upload a lease to their private

And, Ringley Law also offer a

perhaps us bookmarking the 19 essential clauses is for you.

Ever been curious as to how much it might cost you to redecorate the block, replace the roof, repair windows etc... We have a tool that helps all BlockCare members

Because Leaseholder Support.co.uk is part of Ringley - a property company providing services in Building Engineering, Surveying, Valuing and much more - Ringley's Building Engineers have put together a reserves fund estimator specially designed for leaseholders in small blocks.

The tool will guide you through questions such as how wide and deep is your block? how many flats are there? how many windows are there to build up key data on quantities?

It then asks you to rate each key element in simple terms, ie:

From a rate card that our Engineers review each year your "reserves requirement" will then be estimated. You can expand each item to understand how it is made up, ie. the size dimensions that you entered against the rate. There is a guide explaining things like access/scaffolding. Finally you can print your recommended reserves requirement or email to a friend.

Blockcare300 members are protected as we will take care of filing the Statutory Accounts and Confirmation Statements and are responsible for any fines insurred in any full accounting year we are appointed.

To be able to give you this guarantee you appoint us as a Shadow Director just to enable the following:

The filing responsibilities for full or part years prior to, or post our appointment, remain your responsibility.

No Win No Fee Litigation - Arrears Collection

No Win No Fee Litigation - Arrears CollectionIf you demand it wrong, then you cannot collect, so your demands need to:

What Blockcare300 members get is assurance that the service charge demands will stand up in a Court or Tribunal as we will demand the money correctly and prepare and present the service charge accounts to all owners. If necessary we will serve a Section 20B Notice to ensure that you are not prevented from collecting a deficit (should the accounts be late).*

For Blockcare300 members we will send out:

All BlockCare members get protection as Ringley Law will litigate any service charge and ground rent arrears on a no-win, no-fee basis.**

To be eligible

**Arrears accrued prior to becoming a Blockcare300 member, we can still collect these but this will be subject to a chargeable evidencial review to advise you if there any procedural flaws and weigh up the merits of your case. To do so you will need to provide us with:

*Our responsibility for serving Section 20B Notices only applies to each full service charge year that we are appointed.

What if the case needs to go to Court or Tribunal

The no-win no-fee litigation service includes:

If you are unsure about whether you are demanding service charges in accordance with the lease, you should choose Blockcare300 so we manage this risk not you.

All BolckCare members get access to our 70+ Company Secretarial tools, which include:

Specifically:

For Blockcare300 members we will:

For  members we will keep their company running. In short we will:

members we will keep their company running. In short we will:

Members also get access to over 70 company secretarial tools:

members get everything they need to be able to take a professional non-payer to Court of Tribunal for service charge or ground rent arrears.

members get everything they need to be able to take a professional non-payer to Court of Tribunal for service charge or ground rent arrears.

Members get NO WIN, NO FEE litigation on all arrears that accrue during a valid paid up subscription period.

For debts accruing prior to our appointment we can still act - but this will be subject to a chargeable evidencial review to weigh up the merits of your case. To do so you will need to provide us with:

What if the case needs to go to Court or Tribunal

The no-win no-fee litigation service includes:

If you are unsure about whether you are demanding service charges in accordance with the lease, you should choose  so we manage this risk not you.

so we manage this risk not you.

Click to see more about the legal routes available

You cant really put a price on over 100+ factsheets written by our Surveyors, Valuers, Building Engineers and Property Managers (written originally for our staff and free inside knowledge to you). Learn how we make decisions, know what action to take next.

Here's the 8 categories available:

|

Cracks in Exterior Brickwork - "Tapered Cracks: Cracks which are thicker at one end tapering to a thinner crack at the other (often tapering to a hair line crack). Tapered cracks can indicate rotational settlement e.g. extension building is pulling away from main building leaving a gap..." |

|

Concrete Problems in Buildings - "Why are buildings built before 1970 more at risk? All concrete will carbonate to a greater or lesser extent, but the degree of risk depends on how deep the steel is sunk into the concrete and the extent of the protection it has. The level of cover over reinforcing grids or rods, that is cover by way of concrete, should be 50mm minimum and this is now stipulated in building regulations. However, in post war buildings only 1 inch (25mm) was stipulated and therefore carbonation is more likely to be a problem in 1940s, 1950s, and 1960s buildings..." |

For

Credit control is included. We will save you from suffering the embarrasement of needing to chase your neighbour for their arrears. Stages 1 to 3 of debtchase are included in the subscription fee, thereafter, legal action is rechargeable to the debtor.

Credit control is included. We will save you from suffering the embarrasement of needing to chase your neighbour for their arrears. Stages 1 to 3 of debtchase are included in the subscription fee, thereafter, legal action is rechargeable to the debtor.

members can relax whilst we collect what the budgeted service charge.

members can relax whilst we collect what the budgeted service charge.

For  members credit control includes us sending out:

members credit control includes us sending out:

Our processes are compliant with the Civil Procedure Rules pre-action protocol and includes the 30 waiting period prior to which Court action can commence.

Thereafter the debt collection routes are as detailed on the flowcharts below:

All BlockCare members get protection as Ringley Law will litigate any service charge and ground rent arrears on a no-win, no-fee basis.**

To be eligible

member.

member.Credit Control Notes

Note 1 : BlockCare 300 is not suitable where the lease requires retrospective billing.

Note 2 : If service charge is not properly demanded - it may not be recoverable.

Note 3 : If an expense is not presented to an owner within 18 months of it being incurred recovery of it is barred by law (save for where a Section 20B Notice is served). For BlockCare 300 Clients we will serve a Section 20B Notice (if required) for any full service charge year in which we are appointed.

As a Blockcare300 member Ringley Law can help you resolve defective lease issues and get you manageable.

Perhaps your lease

Perhaps it worked well until one owner decides not to pay and now you need to get a robust mechanism that works (after all a Court will only help you collect the arrears if you have done exactly what the lease says.

Using Section 37 of the 1987 Landlord and Tenant Act, so long as:

then Ringley Law can resolve the situation for you through the Tribunal. The decision can be registered against the title to be binding on future owners too.

Blockcare300 members can make payments to contractors and set up recurring payments for things like electricity, insurance premiums, cleaner, gardener etc.... It works a bit like online banking. You key who you want to pay, you can UPLOAD the invoice for safe storage, and then we make the payment for you.

In short there are two authorisation scenarios:

For single person authorisation the lead person presses [SEND] to send the budget or payment request to us for payment, for dual person authorisation, person 1 emails the request to person 2 who then sends the request to us to action.

So you choose the contractors you want and we will pay them, reconcile the bank account and produce the year end service charge accounts.

All BlockCare members get online tools to help them overcome problems that need strategic input.

The most common are:

Support for these services is available to all BlockCare members on a pay as you go basis.

Advice on the principles for controlling or approving alterations is on the members panel, so all BlockCare Members get advice on the processes:

Most leases require a leaseholder to obtain consent before making any alterations - the document that approves the alternations is known as a Licence to Alter.

For obvious reasons there are precautions and procedures that need to be followed before a Licence should be granted. All BlockCare members get access to Ringley Building Engineering who can, as a pay-as-you-go extra, scrutinise proposals, inspect works and recommend that a Licence is granted (or not with reasons). Fees are chargeable to the owner wanting to make the alterations.

The most common alterations that do require a "Licence to Alter" are:

All members can use

Ringley Building Engineering Team to provide:

Ringley Building Engineering Team to provide: Ringley Law to:

Ringley Law to:

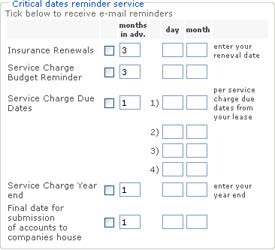

All BlockCare members can set up email reminders.

For example

Blockcare300 members can relax as even IF you forget to log on and enter the service charge budget you want us to collect - we will simply apply a 10% increase to keep the block running, until you do